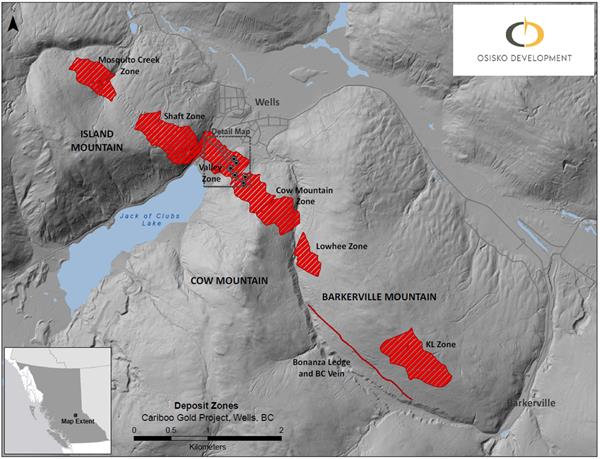

MONTREAL, June 24, 2021 (GLOBE NEWSWIRE) -- Osisko Development Corp. (“Osisko Development” or the “Company”) (TSX.V-ODV) is pleased to announce further drilling results from the 200,000-meter 2021 exploration and category conversion drill program campaign at its Cariboo Gold Project (“Cariboo”) in central British Columbia. A total of ten diamond drill rigs are currently on the Project.

Drilling Summary

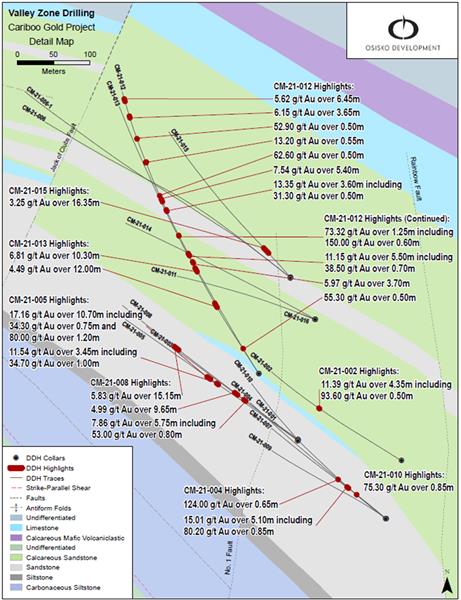

- A total of 68 holes and 30,000 drilled meters thus far in 2021 at Valley Zone, located between the Shaft and Cow deposits.

- Recent assay results include holes CM-21-001 to CM-21-016 (Figure 1).

- CM-21-005 intersected a modelled vein corridor that assayed 17.16 g/t Au over 10.7 meters, increasing confidence in the existing model (Figure 2).

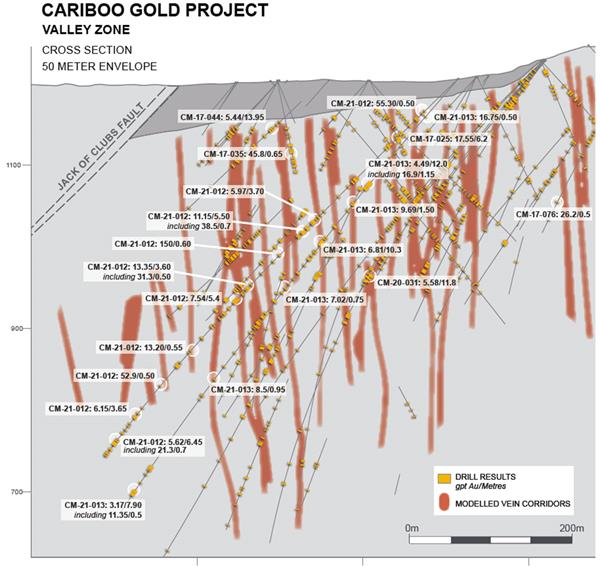

- Drillhole CM-21-012 intersected 10 mineralized vein corridors at least 3 meters wide extending vein corridors down to vertical depths of 440 meters and additional high-grade samples including 150 g/t Au over 0.50 meters, 62.6 g/t Au over 0.50 meter and 52.9 g/t Au over 0.50 meter (Figure 3).

- Detailed drilling results, a drill hole location plan map and vertical cross section are presented at the end of this release.

Recent Drilling Highlights:

- 11.39 g/t Au over 4.35 meters in CM-21-002 including

- 93.60 g/t Au over 0.50 meter

- 15.01 g/t Au over 5.10 meters in CM-21-004 including

- 80.20 g/t Au over 0.85 meter

- 124.00 g/t Au over 0.65 meter in CM-21-004

- 11.54 g/t Au over 3.45 meters in CM-21-005 including

- 34.70 g/t Au over 1.00 meter

- 17.16 g/t Au over 10.70 meters in CM-21-005 including

- 80.00 g/t Au over 1.20 meters

- 7.86 g/t Au over 5.75 meters in CM-21-008 including

- 53.00 g/t Au over 0.80 meter

- 4.99 g/t Au over 9.65 meters in CM-21-008

- 5.83 g/t Au over 15.15 meters in CM-21-008

- 75.30 g/t Au over 0.85 meter in CM-21-010

- 55.30 g/t Au over 0.50 meter in CM-21-012

- 11.15 g/t Au over 5.50 meters in CM-21-012 including

- 38.50 g/t Au over 0.70 meter

- 73.32 g/t Au over 1.25 meters in CM-21-012 including

- 150.00 g/t Au over 0.60 meter in CM-21-012

- 13.35 g/t Au over 3.60 meters in CM-21-012

- 7.54 g/t Au over 5.40 meters in CM-21-012

- 62.60 g/t Au over 0.50 meter in CM-21-012

- 52.90 g/t Au over 0.50 meter in CM-21-012

- 5.62 g/t Au over 6.45 meters in CM-21-012

- 4.49 g/t Au over 12.00 meters in CM-21-013

- 6.81 g/t Au over 10.30 meters in CM-21-013

- 3.25 g/t Au over 16.35 meters in CM-21-015

Chris Lodder, President of Osisko Development commented, “The primary focus of the drilling at Valley Zone is to increase indicated category ounces to support our ongoing feasibility study. These excellent results from Valley Zone are hitting our designed targets and expanding the vein corridors at depth.”

Mineralized quartz veins on Cariboo are overall sub-vertical dip and northeast strike. Vein corridors are defined as a high-density network of mineralized quartz veins within the axis of the last folding events and hosted within a brittle meta-sandstone or calcareous meta-sandstone. Vein corridors are modelled at a minimum thickness of 2.0 meters and average about 4.5 meters true width. Individual mineralized veins within these corridors have widths varying from centimeters to several meters and strike lengths from a few meters to over 50 meters. These corridors have been defined from surface to a vertical depth averaging 300 meters and remain open for expansion at depth and along strike. Gold grades are intimately associated with quartz vein-hosted pyrite as well as pyritic, intensely silicified wall rock haloes in close proximity to the veins.

True widths are estimated to be 60% to 75% of reported core length intervals. Intervals not recovered by drilling were assigned zero grade. Top cuts have not been applied to high grade assays. Complete assay highlights are presented in Table 1, drill hole locations are listed in Table 2.

Corporate Matters

The Corporation is pleased to announce that incentive stock options have been granted to officers to purchase 492,600 common shares at a price of $7.10 for five years with vesting terms of; one third (1/3) on June 23rd 2022, one third (1/3) on June 23rd 2023 and one third (1/3) on June 23rd 2024. These options have been granted in accordance with the Corporation’s Stock Option Plan.

The Company has also granted an aggregate total of 427,100 restricted share units (“RSUs”) to officers in accordance with the RSU Plan of the Company. All RSUs will vest on June 23rd 2024.

Figure 1 is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/8d35c79c-af98-4ed3-a27a-26ba85ff244d

Figure 2 is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/7164bf5f-d4d9-4612-bbfd-34633198a28f

Figure 3 is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/4e1b881e-01b1-4f35-b0c6-eb0f084c7578

Qualified Persons

Per National Instrument 43-101 Standards of Disclosure for Mineral Projects, Maggie Layman, P.Geo. Vice President Exploration of Osisko Development Corp., is a Qualified Person and has prepared, validated, and approved the technical and scientific content of this news release.

Quality Assurance – Quality Control

Once received and processed, all drill core samples are sawn in half, labelled and bagged. The remaining drill core is subsequently stored on site at a secured facility in Wells, BC. Numbered security tags are applied to lab shipments for chain of custody requirements. Quality control (QC) samples are inserted at regular intervals in the sample stream, including blanks and reference materials with all sample shipments to monitor laboratory performance. The QAQC program was designed and approved by Lynda Bloom, P.Geo. of Analytical Solutions Ltd.

Drill core samples are submitted to ALS Geochemistry’s analytical facility in North Vancouver, British Columbia for preparation and analysis. The ALS facility is accredited to the ISO/IEC 17025 standard for gold assays and all analytical methods include quality control materials at set frequencies with established data acceptance criteria. The entire sample is crushed, and 250 grams is pulverized. Analysis for gold is by 50g fire assay fusion with atomic absorption (AAS) finish with a lower limit of 0.01 ppm and upper limit of 100 ppm. Samples with gold assays greater than 100 ppm are re-analyzed using a 1,000g screen metallic fire assay. A selected number of samples are also analyzed using a 48 multi-elemental geochemical package by a 4-acid digestion, followed by Inductively Coupled Plasma Atomic Emission Spectroscopy (ICP-AES) and Inductively Coupled Plasma Mass Spectroscopy (ICP-MS).

About Osisko Development Corp.

Osisko Development Corp. is well-capitalized and uniquely positioned as a premier gold development company in North America to advance the Cariboo Gold Project and other Canadian and Mexican properties, with the objective of becoming the next mid-tier gold producer. The Cariboo Gold Project, located in central British Columbia, is Osisko Development's flagship asset with measured and indicated resources of 21.44 Mt at 4.6 Au g/t for a total of 3.2 million ounces of gold and inferred resource of 21.69 Mt at 3.9 Au g/t for a total of 2.7 million ounces of gold (see NI 43-101 Technical Report for resource October 5th, 2020). The considerable exploration potential at depth and along strike distinguishes the Cariboo Gold Project relative to other development assets as does the historically low, all-in discovery costs of US $19 per ounce. The Cariboo Gold Project is advancing through permitting as a 4,750 tonnes per day underground operation with a feasibility study on track for completion in the second half of 2021. Osisko Development's project pipeline is complemented by potential near-term production targeted from the San Antonio gold project, located in Sonora Mexico and early exploration stage properties including the Coulon Project and James Bay Properties located in Québec as well as the Guerrero Properties located in Mexico. Osisko Development began trading on the TSX Venture Exchange under the symbol "ODV" on December 2, 2020.

| For further information, please contact Osisko Development Corp.: |

Jean Francois Lemonde

Vice President, Investor Relations

jflemonde@osiskodev.com

Tel: 514-299-4926 |

Forward-looking Statements

Certain statements contained in this press release may be deemed “forward-looking statements” within the meaning of applicable Canadian and U.S. securities laws. These forward-looking statements, by their nature, require Osisko Development to make certain assumptions and necessarily involve known and unknown risks and uncertainties that could cause actual results to differ materially from those expressed or implied in these forward-looking statements. Forward-looking statements are not guarantees of performance. Words such as “may”, “will”, “would”, “could”, “expect”, “believe”, “plan”, “anticipate”, “intend”, “estimate”, “continue”, or the negative or comparable terminology, as well as terms usually used in the future and the conditional, are intended to identify forward-looking statements. Information contained in forward-looking statements is based upon certain material assumptions that were applied in drawing a conclusion or making a forecast or projection, including management’s perceptions of historical trends, current conditions and expected future developments, results of further exploration work to define and expand mineral resources, expected conclusions of optimization studies, that vein corridors continue to be defined as a high-density network of mineralized quartz within the axis of the last folding event’s fold and hosted within the sandstones and that the deposit remains open for expansion at depth and down plunge, that such results from Valley Zone will continue to hit the designed targets and expand the vein corridors at depth, as well as other considerations that are believed to be appropriate in the circumstances. Osisko Development considers its assumptions to be reasonable based on information currently available, but cautions the reader that their assumptions regarding future events, many of which are beyond the control of Osisko, may ultimately prove to be incorrect since they are subject to risks and uncertainties that affect Osisko Development and its business. Such risks and uncertainties include, among others, risks relating to the ability of exploration activities (including drill results) to accurately predict mineralization; errors in management’s geological modelling; the ability of to complete further exploration activities, including drilling; property and royalty interests in the Cariboo gold deposit; the ability of the Corporation to obtain required approvals; the results of exploration activities; risks relating to mining activities; the global economic climate; metal prices; dilution; environmental risks; and community and non-governmental actions and the responses of relevant governments to the COVID-19 outbreak and the effectiveness of such responses.

For additional information with respect to these and other factors and assumptions underlying the forward-looking statements made in this news release concerning Osisko Development, see the Filing Statement available electronically on SEDAR (www.sedar.com) under Osisko Development's issuer profile. The forward-looking statements set forth herein concerning Osisko Development reflect management's expectations as at the date of this news release and are subject to change after such date. Osisko Development disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, other than as required by law.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release. No stock exchange, securities commission or other regulatory authority has approved or disapproved the information contained herein.

Table 1: Cariboo Gold Project 2021 Length Weighted Drill Hole Gold Composites

| HOLE ID | | FROM M | TO (M) | LENGTH (M) | AU G/T |

| CM-21-001 | HOLE ABANDONDED | | | | |

| CM-21-002 | | 80.90 | 82.40 | 1.50 | 7.65 |

| | INCLUDING | 80.90 | 81.90 | 1.00 | 9.46 |

| | | 217.55 | 221.90 | 4.35 | 11.39 |

| | INCLUDING | 219.50 | 220.00 | 0.50 | 93.60 |

| | | 231.00 | 231.50 | 0.50 | 4.12 |

| | | 237.20 | 237.70 | 0.50 | 5.93 |

| | | 250.30 | 252.25 | 1.95 | 8.29 |

| | INCLUDING | 251.10 | 251.75 | 0.65 | 23.70 |

| CM-21-003 | | 77.50 | 78.00 | 0.50 | 4.40 |

| | | 151.00 | 151.60 | 0.60 | 21.20 |

| | | 157.80 | 158.50 | 0.70 | 16.40 |

| | | 168.50 | 169.00 | 0.50 | 9.54 |

| | | 179.00 | 181.90 | 2.90 | 3.34 |

| | INCLUDING | 179.50 | 180.50 | 1.00 | 8.74 |

| | | 186.85 | 187.35 | 0.50 | 6.45 |

| | | 195.00 | 195.70 | 0.70 | 16.50 |

| | | 205.85 | 206.35 | 0.50 | 6.77 |

| | | 292.20 | 293.70 | 1.50 | 3.82 |

| | | 294.90 | 295.85 | 0.95 | 3.50 |

| CM-21-004 | | 10.50 | 11.75 | 1.25 | 5.60 |

| | | 40.50 | 41.00 | 0.50 | 5.60 |

| | | 44.65 | 45.15 | 0.50 | 3.15 |

| | | 77.85 | 79.50 | 1.65 | 7.69 |

| | INCLUDING | 78.35 | 79.50 | 1.15 | 10.55 |

| | | 93.55 | 98.65 | 5.10 | 15.01 |

| | INCLUDING | 97.80 | 98.65 | 0.85 | 80.20 |

| | | 106.85 | 109.40 | 2.55 | 5.98 |

| | INCLUDING | 108.70 | 109.40 | 0.70 | 18.65 |

| | | 121.45 | 122.10 | 0.65 | 124.00 |

| | | 167.50 | 169.55 | 2.05 | 3.77 |

| | INCLUDING | 167.50 | 168.00 | 0.50 | 11.25 |

| CM-21-005 | | 162.10 | 162.60 | 0.50 | 4.07 |

| | | 171.00 | 175.80 | 4.80 | 5.46 |

| | INCLUDING | 171.00 | 171.50 | 0.50 | 44.70 |

| | | 200.40 | 201.75 | 1.35 | 5.11 |

| | INCLUDING | 201.00 | 201.75 | 0.75 | 7.41 |

| | | 205.50 | 206.00 | 0.50 | 17.60 |

| | | 208.75 | 212.20 | 3.45 | 11.54 |

| | INCLUDING | 211.20 | 212.20 | 1.00 | 34.70 |

| | | 217.45 | 222.00 | 4.55 | 3.74 |

| | INCLUDING | 217.45 | 218.25 | 0.80 | 6.95 |

| | AND | 219.25 | 220.05 | 0.80 | 2.64 |

| | AND | 221.45 | 222.00 | 0.55 | 16.80 |

| | | 228.10 | 238.80 | 10.70 | 17.16 |

| | INCLUDING | 228.10 | 229.35 | 1.25 | 20.20 |

| | AND | 229.35 | 230.85 | 1.50 | 9.67 |

| | AND | 231.60 | 232.35 | 0.75 | 34.30 |

| | AND | 232.35 | 233.20 | 0.85 | 22.10 |

| | AND | 233.20 | 234.40 | 1.20 | 80.00 |

| | | 263.40 | 264.80 | 1.40 | 4.67 |

| | | 318.70 | 319.40 | 0.70 | 5.05 |

| CM-21-006 | | 95.40 | 96.00 | 0.60 | 5.78 |

| | | 103.45 | 104.50 | 1.05 | 4.53 |

| | INCLUDING | 103.45 | 103.95 | 0.50 | 6.48 |

| | | 120.30 | 120.90 | 0.60 | 4.88 |

| | | 160.10 | 161.00 | 0.90 | 3.07 |

| | | 177.00 | 177.60 | 0.60 | 8.66 |

| | | 294.00 | 295.50 | 1.50 | 10.30 |

| | | 309.70 | 312.65 | 2.95 | 5.16 |

| | INCLUDING | 312.00 | 312.65 | 0.65 | 7.49 |

| | | 419.20 | 422.30 | 3.10 | 7.43 |

| | INCLUDING | 419.20 | 420.15 | 0.95 | 18.95 |

| | | 447.30 | 448.10 | 0.80 | 14.05 |

| | | 460.00 | 460.50 | 0.50 | 3.96 |

| | | 462.70 | 463.20 | 0.50 | 4.89 |

| | | 481.00 | 481.80 | 0.80 | 3.43 |

| | | 504.50 | 505.60 | 1.10 | 4.14 |

| | | 514.40 | 520.30 | 5.90 | 3.53 |

| | INCLUDING | 518.10 | 518.70 | 0.60 | 27.50 |

| | AND | 519.80 | 520.30 | 0.50 | 5.05 |

| | | 527.25 | 527.80 | 0.55 | 11.25 |

| CM-21-006-1 | | 179.50 | 185.80 | 6.30 | 2.82 |

| | INCLUDING | 180.00 | 180.50 | 0.50 | 22.60 |

| | | 287.50 | 288.00 | 0.50 | 5.27 |

| | | 314.50 | 316.50 | 2.00 | 8.40 |

| | INCLUDING | 314.50 | 315.00 | 0.50 | 18.40 |

| | AND | 315.00 | 315.50 | 0.50 | 13.10 |

| | | 438.60 | 439.10 | 0.50 | 8.98 |

| | | 442.40 | 443.45 | 1.05 | 7.97 |

| | | 447.50 | 448.00 | 0.50 | 3.73 |

| | | 449.00 | 449.50 | 0.50 | 6.59 |

| | | 453.20 | 453.70 | 0.50 | 2.97 |

| | | 468.05 | 470.65 | 2.60 | 4.25 |

| | | 475.50 | 476.00 | 0.50 | 20.20 |

| | | 493.25 | 498.00 | 4.75 | 3.46 |

| | INCLUDING | 495.65 | 497.10 | 1.45 | 7.40 |

| | | 716.85 | 717.85 | 1.00 | 6.19 |

| | INCLUDING | 716.85 | 717.35 | 0.50 | 10.25 |

| CM-21-007 | | 50.35 | 50.85 | 0.50 | 3.90 |

| | | 81.90 | 82.55 | 0.65 | 3.08 |

| | | 96.65 | 100.00 | 3.35 | 2.91 |

| | INCLUDING | 96.65 | 97.80 | 1.15 | 6.48 |

| | | 161.75 | 162.40 | 0.65 | 5.36 |

| | | 241.00 | 241.60 | 0.60 | 6.35 |

| CM-21-008 | | 146.25 | 152.00 | 5.75 | 7.86 |

| | INCLUDING | 151.20 | 152.00 | 0.80 | 53.00 |

| | | 169.50 | 179.15 | 9.65 | 4.99 |

| | INCLUDING | 169.50 | 170.90 | 1.40 | 9.18 |

| | AND | 170.90 | 171.70 | 0.80 | 3.21 |

| | AND | 175.00 | 176.50 | 1.50 | 9.06 |

| | AND | 178.65 | 179.15 | 0.50 | 37.60 |

| | | 192.50 | 193.00 | 0.50 | 6.24 |

| | | 205.90 | 207.00 | 1.10 | 4.09 |

| | | 232.00 | 235.00 | 3.00 | 4.63 |

| | INCLUDING | 234.15 | 235.00 | 0.85 | 10.05 |

| | | 349.65 | 364.80 | 15.15 | 5.83 |

| | INCLUDING | 349.65 | 350.15 | 0.50 | 7.36 |

| | AND | 350.75 | 352.00 | 1.25 | 16.25 |

| | AND | 353.00 | 354.50 | 1.50 | 11.10 |

| | AND | 358.00 | 358.60 | 0.60 | 7.27 |

| | AND | 361.50 | 362.00 | 0.50 | 30.40 |

| | AND | 362.50 | 363.00 | 0.50 | 14.65 |

| | AND | 363.00 | 363.50 | 0.50 | 7.29 |

| | | 418.50 | 419.00 | 0.50 | 3.14 |

| CM-21-009 | | 17.50 | 18.00 | 0.50 | 5.52 |

| | | 52.10 | 52.70 | 0.60 | 22.90 |

| | | 82.50 | 83.15 | 0.65 | 6.11 |

| | | 101.00 | 102.00 | 1.00 | 14.25 |

| | | 188.65 | 192.85 | 4.20 | 3.52 |

| | INCLUDING | 188.65 | 189.15 | 0.50 | 19.85 |

| | AND | 192.30 | 192.85 | 0.55 | 6.78 |

| CM-21-010 | | 82.95 | 83.80 | 0.85 | 75.30 |

| | | 95.85 | 96.85 | 1.00 | 4.05 |

| | | 98.85 | 100.00 | 1.15 | 3.02 |

| | | 190.10 | 190.85 | 0.75 | 4.71 |

| | | 242.05 | 242.55 | 0.50 | 12.70 |

| | | 260.55 | 261.20 | 0.65 | 3.13 |

| CM-21-011 | | 38.00 | 41.50 | 3.50 | 3.23 |

| | INCLUDING | 38.00 | 38.50 | 0.50 | 19.35 |

| | | 115.90 | 117.00 | 1.10 | 6.28 |

| | | 288.20 | 288.80 | 0.60 | 5.70 |

| CM-21-012 | | 56.90 | 57.40 | 0.50 | 55.30 |

| | | 123.75 | 124.25 | 0.50 | 6.47 |

| | | 241.85 | 242.50 | 0.65 | 3.03 |

| | | 248.45 | 252.15 | 3.70 | 5.97 |

| | INCLUDING | 248.45 | 248.95 | 0.50 | 28.80 |

| | | 258.60 | 262.50 | 3.90 | 3.28 |

| | INCLUDING | 261.50 | 262.00 | 0.50 | 8.27 |

| | | 265.00 | 270.50 | 5.50 | 11.15 |

| | INCLUDING | 265.50 | 266.20 | 0.70 | 38.50 |

| | AND | 266.20 | 266.90 | 0.70 | 14.50 |

| | AND | 266.90 | 267.40 | 0.50 | 19.25 |

| | | 273.65 | 275.80 | 2.15 | 7.25 |

| | INCLUDING | 273.65 | 274.15 | 0.50 | 16.50 |

| | | 274.80 | 275.80 | 1.00 | 7.29 |

| | | 307.75 | 309.00 | 1.25 | 73.32 |

| | INCLUDING | 308.40 | 309.00 | 0.60 | 150.00 |

| | | 319.10 | 319.70 | 0.60 | 8.47 |

| | | 339.80 | 340.30 | 0.50 | 3.75 |

| | | 362.75 | 366.35 | 3.60 | 13.35 |

| | INCLUDING | 362.75 | 363.25 | 0.50 | 31.30 |

| | AND | 363.25 | 364.10 | 0.85 | 25.50 |

| | AND | 365.75 | 366.35 | 0.60 | 10.65 |

| | | 371.25 | 375.00 | 3.75 | 5.26 |

| | INCLUDING | 371.25 | 371.80 | 0.55 | 15.50 |

| | AND | 374.00 | 374.50 | 0.50 | 19.90 |

| | | 381.40 | 381.90 | 0.50 | 3.59 |

| | | 383.50 | 388.90 | 5.40 | 7.54 |

| | INCLUDING | 384.25 | 384.75 | 0.50 | 7.96 |

| | AND | 386.15 | 387.00 | 0.85 | 19.25 |

| | AND | 387.00 | 387.70 | 0.70 | 19.90 |

| | | 396.85 | 397.35 | 0.50 | 62.60 |

| | | 404.70 | 408.10 | 3.40 | 5.17 |

| | INCLUDING | 404.70 | 405.20 | 0.50 | 9.76 |

| | AND | 406.30 | 407.10 | 0.80 | 12.15 |

| | | 415.15 | 415.75 | 0.60 | 12.10 |

| | | 428.75 | 429.30 | 0.55 | 8.12 |

| | | 446.50 | 448.00 | 1.50 | 4.01 |

| | | 471.15 | 471.70 | 0.55 | 13.20 |

| | | 487.25 | 487.75 | 0.50 | 5.75 |

| | | 490.80 | 495.10 | 4.30 | 5.41 |

| | INCLUDING | 492.65 | 493.25 | 0.60 | 9.73 |

| | AND | 493.80 | 494.60 | 0.80 | 12.45 |

| | | 524.90 | 525.40 | 0.50 | 52.90 |

| | | 559.50 | 560.00 | 0.50 | 5.14 |

| | | 572.80 | 576.45 | 3.65 | 6.15 |

| | INCLUDING | 572.80 | 573.30 | 0.50 | 16.50 |

| | AND | 573.30 | 573.80 | 0.50 | 10.85 |

| | AND | 575.85 | 576.45 | 0.60 | 10.40 |

| | | 588.00 | 588.50 | 0.50 | 4.44 |

| | | 599.00 | 600.50 | 1.50 | 5.37 |

| | INCLUDING | 599.00 | 599.50 | 0.50 | 13.00 |

| | | 608.85 | 609.35 | 0.50 | 10.70 |

| | | 610.95 | 617.40 | 6.45 | 5.62 |

| | INCLUDING | 610.95 | 611.45 | 0.50 | 5.69 |

| | AND | 614.10 | 614.60 | 0.50 | 13.10 |

| | AND | 614.60 | 615.10 | 0.50 | 7.18 |

| | AND | 615.10 | 615.80 | 0.70 | 21.30 |

| | AND | 616.30 | 616.90 | 0.60 | 6.17 |

| CM-21-013 | | 60.55 | 61.05 | 0.50 | 16.75 |

| | | 126.90 | 128.30 | 1.40 | 7.95 |

| | | 166.00 | 178.00 | 12.00 | 4.49 |

| | INCLUDING | 167.50 | 168.65 | 1.15 | 16.90 |

| | AND | 169.95 | 171.40 | 1.45 | 6.48 |

| | | 210.00 | 211.50 | 1.50 | 9.69 |

| | | 255.55 | 265.85 | 10.30 | 6.81 |

| | INCLUDING | 255.55 | 256.10 | 0.55 | 21.30 |

| | AND | 258.85 | 260.00 | 1.15 | 11.35 |

| | AND | 262.20 | 263.00 | 0.80 | 30.70 |

| | | 276.00 | 276.70 | 0.70 | 5.29 |

| | | 333.25 | 334.00 | 0.75 | 7.02 |

| | | 353.50 | 354.40 | 0.90 | 6.22 |

| | | 371.50 | 373.10 | 1.60 | 7.47 |

| | INCLUDING | 372.45 | 373.10 | 0.65 | 11.70 |

| | | 392.40 | 395.75 | 3.35 | 5.32 |

| | INCLUDING | 392.40 | 393.35 | 0.95 | 7.46 |

| | AND | 395.15 | 395.75 | 0.60 | 17.50 |

| | | 474.50 | 475.45 | 0.95 | 8.50 |

| | | 618.00 | 618.50 | 0.50 | 3.25 |

| | | 641.50 | 649.40 | 7.90 | 3.17 |

| | INCLUDING | 642.30 | 643.00 | 0.70 | 6.28 |

| | AND | 646.30 | 646.80 | 0.50 | 11.35 |

| CM-21-014 | | 155.70 | 159.30 | 3.60 | 6.43 |

| | INCLUDING | 155.70 | 156.20 | 0.50 | 22.80 |

| | AND | 158.80 | 159.30 | 0.50 | 21.80 |

| | | 266.80 | 275.50 | 8.70 | 2.78 |

| | INCLUDING | 266.80 | 267.30 | 0.50 | 20.00 |

| | AND | 272.00 | 272.80 | 0.80 | 5.29 |

| | AND | 274.20 | 275.50 | 1.30 | 6.31 |

| | | 313.25 | 318.50 | 5.25 | 4.32 |

| | INCLUDING | 313.25 | 314.25 | 1.00 | 14.05 |

| | AND | 317.90 | 318.50 | 0.60 | 8.28 |

| CM-21-015 | | 66.15 | 82.50 | 16.35 | 3.25 |

| | INCLUDING | 68.60 | 69.25 | 0.65 | 11.40 |

| | AND | 73.05 | 74.45 | 1.40 | 12.80 |

| | AND | 77.10 | 77.60 | 0.50 | 4.21 |

| | AND | 77.60 | 78.10 | 0.50 | 12.85 |

| | AND | 81.25 | 82.50 | 1.25 | 4.57 |

| | | 110.25 | 110.75 | 0.50 | 29.10 |

| | | 126.05 | 126.55 | 0.50 | 15.90 |

| | | 288.75 | 289.25 | 0.50 | 9.88 |

| | | 293.50 | 294.00 | 0.50 | 24.00 |

| | | 303.70 | 304.20 | 0.50 | 5.29 |

| | | 316.70 | 319.35 | 2.65 | 13.67 |

| | INCLUDING | 316.70 | 317.55 | 0.85 | 16.35 |

| | AND | 317.55 | 318.05 | 0.50 | 33.90 |

| | | 321.00 | 321.50 | 0.50 | 9.83 |

| | | 324.50 | 327.75 | 3.25 | 3.48 |

| | INCLUDING | 325.30 | 325.80 | 0.50 | 11.70 |

| | AND | 327.25 | 327.75 | 0.50 | 7.22 |

| | | 331.40 | 332.00 | 0.60 | 19.75 |

| CM-21-016 | | 25.00 | 26.10 | 1.10 | 6.09 |

| | | 38.60 | 39.10 | 0.50 | 8.93 |

| | | 50.65 | 51.30 | 0.65 | 7.47 |

Table 2: Drill Hole Locations and Orientations

| HOLE ID | EASTING | NORTHING | ELEV | DIP | AZI | DEPTH (M) |

| CM-21-001 | 595545 | 5883877 | 1227 | -45 | 307 | 60 |

| CM-21-002 | 595688 | 5883850 | 1267 | -49 | 302 | 366 |

| CM-21-003 | 595545 | 5883877 | 1229 | -45 | 307 | 327 |

| CM-21-004 | 595666 | 5883770 | 1282 | -45 | 309 | 360 |

| CM-21-005 | 595545 | 5883877 | 1228 | -48 | 305 | 471 |

| CM-21-006 | 595535 | 5884102 | 1224 | -45 | 308 | 654 |

| CM-21-006-1 | 595535 | 5884102 | 1224 | -45 | 308 | 759 |

| CM-21-007 | 595666 | 5883770 | 1282 | -48 | 310 | 330 |

| CM-21-008 | 595545 | 5883879 | 1229 | -52 | 305 | 546 |

| CM-21-009 | 595667 | 5883770 | 1283 | -50 | 303 | 324 |

| CM-21-010 | 595666 | 5883769 | 1283 | -51 | 309 | 441 |

| CM-21-011 | 595568 | 5884044 | 1225 | -49 | 292 | 333 |

| CM-21-012 | 595491 | 5883969 | 1206 | -44 | 328 | 634 |

| CM-21-013 | 595491 | 5883969 | 1206 | -50 | 328 | 677 |

| CM-21-014 | 595569 | 5884044 | 1225 | -54 | 299 | 567 |

| CM-21-015 | 595535 | 5884102 | 1224 | -48 | 317 | 428 |

| CM-21-016 | 595569 | 5884044 | 1224 | -62 | 291 | 60

|