TORONTO, Feb. 23, 2022 (GLOBE NEWSWIRE) -- Marathon Gold Corporation (“Marathon” or the “Company”; TSX: MOZ) is pleased to provide an update on the 2021 Reverse Circulation (“RC”) drill program conducted on the Marathon and Leprechaun Deposits of the Valentine Gold Project (the “Project”) located in the central region of Newfoundland and Labrador.

The 2021 RC drill program was designed to provide validation to the Project’s Mineral Reserve block model within the Phase 1 pits of each of the Marathon and Leprechaun Deposits, and to help develop plans for mining grade control. Overall, 50 holes for a total of 2,342 metres were drilled at Leprechaun and 251 holes for 9,786 metres were drilled at Marathon. A significant quantity of assays required to complete the program are still outstanding. However, sufficient data have been received to allow for a preliminary report on the program’s results.

Matt Manson, President and CEO, stated: “We are reporting preliminary but encouraging results today from our 2021 RC drill program. This program is an important and necessary quality-assurance step for the Valentine Gold Project ahead of a potential construction decision. Its primary purpose is to identify any areas of risk in our estimates of gold content, especially in the early benches of our two Mineral Reserve pits. The data we have received to date is predominantly from conventional fire assays, which historically understate gold content at Valentine compared to the screen metallic fire assay method (upon which our Mineral Resource estimates are based). Nonetheless, we are encouraged by the program’s results. We are seeing long intercepts of high-grade mineralisation within the core areas of each of the Marathon and Leprechaun block models. Most importantly, we are reporting excellent continuity of vein mineralisation at the 6-metre scale of the proposed mining blocks, confirming the fundamental basis-of-estimate of our Mineral Resources and demonstrating the viability of our proposed mining methods. In this news release we are presenting detailed sections from the Leprechaun and Marathon Deposits comparing the RC dataset with the underlying Mineral Reserve block model and historical diamond drill holes. These validation exercises are giving us good insight into areas of our block models that may be variously understated or overstated in gold content. This will in turn allow us to improve the quality of our geological modelling and Mineral Resource estimates, and our grade control practices, well ahead of our planned mining.”

The 2021 RC Drill Program

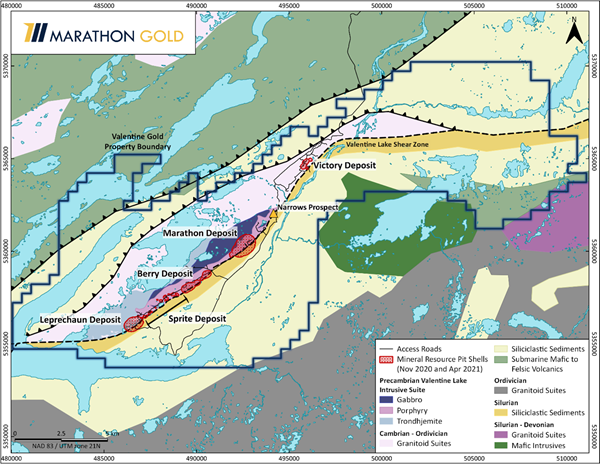

Gold mineralization at the Valentine Gold Project is contained in Quartz-Tourmaline-Pyrite-Gold (“QTP-Au”) veins developed within granitoid rocks on the hanging wall, or northwest, side of the Valentine Lake Shear Zone (Figure 1). Up to four orientations of veins have been measured, with shallowly southwest dipping “Set 1” QTP-Au veins observed to be dominant in both abundance and gold content. At the Leprechaun and Marathon Deposits, as well as at the new Berry Deposit, Set 1 QTP-Au veins form densely stacked corridors of mineralisation referred to as “Main Zones”. The extent and scale of these mineralised corridors appear related to the size and frequency of sheared mafic dykes which extend northeast-southwest within the granitoid rocks, parallel to the shear zone. The block models utilized in the Leprechaun and Marathon Mineral Resource estimates are based on the estimated abundance, continuity, and grade of Set 1 veins within the constraints of an overall grade shell and a series of interpreted geological domains. Diamond drill holes supporting these block model estimates are spaced at between 12.5 and 25 metres in the main mineralized areas.

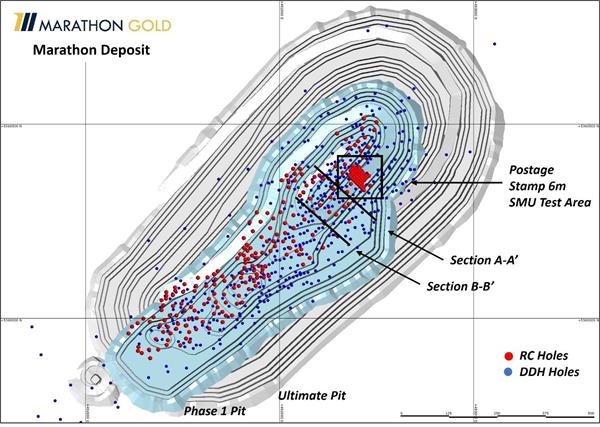

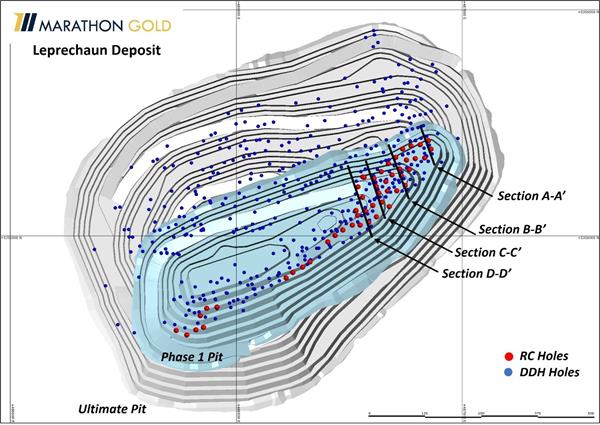

The 2021 RC drill holes averaged between 30 and 60 metres in depth and were located so as to give broad coverage of the Mineral Reserve block models within the Phase 1 pits of each of the Marathon and Leprechaun Deposits, as described in the Project’s April 2021 Feasibility Study. More drill holes were completed at the Marathon Deposit due to better surface access. In addition to these widely spaced RC holes, a special test area at the Marathon Deposit named the “Postage Stamp” was drilled in a tight 6 by 6 metre grid to test for mineralization continuity at the scale of the Project’s proposed Selective Mining Unit (“SMU”) of 6 metre blocks, as used in the estimate of Mineral Reserves. At Leprechaun, angled holes were drilled on azimuths of approximately 340 or 160 degrees to duplicate the angle of incidence of diamond drilling on the southwest dipping Set 1 veins. At Marathon, holes were drilled vertically to simulate mine grade control practices.

Figure 1: Location Map, Valentine Gold Project

https://www.globenewswire.com/NewsRoom/AttachmentNg/a470343c-2287-40d2-9b4c-0f6f6d99453b

RC chips were sampled as 4 to 5 kilogram splits of 2 metre drill intervals. These samples were initially sent for gold recovery by screen metallic fire assay, the analytical method utilized in the Project’s Mineral Resource estimate. However, after slower than expected laboratory turnaround, samples were sent for gold analysis first by conventional fire assay with a view to resending sample pulps for metallic screening for those samples showing anomalous gold content (see Sample Processing and Quality Assurance-Quality Control).

Fire assay by screen metallics is a well-established technique for measuring coarse gold, such as occurs at the Valentine Gold Project. Since 2010, the Company has processed several tens of thousands of diamond drill hole samples by both methods. Marathon’s standard practice has been to perform a screen metallic fire assay for samples that return an initial conventional fire assay greater than 0.3 g/t Au. Average sample grades at the Leprechaun Deposit have been +10% after screen metallics (+11% when capped at 100 g/t Au) and +23% at the Marathon Deposit (+15% when capped at 100 g/t Au). This difference is interpreted to reflect the sample-sizes used in each method. At time of writing, over 1,200 screen metallic RC samples remain outstanding (Table 1). This includes 1101 samples from the Marathon Deposit, approximately one quarter of all samples with fire assay data. Hence, any interpretation of results from the 2021 RC Program should be considered preliminary until all screen metallic results have been received.

Table 1: Status Sample Processing from 2021 RC Drill Program

| Deposit | Holes Drilled | Meters Drilled | Number of 2m Samples | Assays Received: Metallic Screening | Assays Received: Fire Assay | Assays Outstanding: Metallic Screening |

| Leprechaun | 50 | 2,342 | 1,100 | 672 | 428 | 131 |

| Marathon | 251 | 9,786 | 4,391 | 0 | 4,391 | 1101 |

Note: Sample counts will not sum, since not all intervals with fire assay results were chosen for duplicate analysis by metallic screens.

Individual RC hole results received to date include the following. In the Marathon Deposit:

- MA-RC-21-025 intersected 2.01 g/t Au over 60 metres between 0 and 60 metres, including 10.84 g/t Au over 2 metres, in a 60 metre deep hole, by fire assay;

- MA-RC-21-202 intersected 9.08 g/t Au over 22 metres between 8 and 30 metres, including 29.39 g/t Au over 6 metres, in a 36 metre deep hole, by fire assay;

- MA-RC-21-007 intersected 3.92 g/t Au over 18 metres between 8 and 26 metres, including 17.73 g/t Au over 2 metres, in a 60 metre deep hole, by fire assay;

- MA-RC-21-152 intersected 2.38 g/t Au over 28 metres between 8 and 36 metres, including 15.73 g/t Au over 2 metres, in a 36 metre deep hole, by fire assay;

- MA-RC-21-127 intersected 16.68 g/t Au over 6 metres between 22 and 28 metres, including 32.62 g/t Au over 2 metres, in a 40 metre deep hole, by fire assay;

- MA-RC-21-022 intersected 1.87 g/t Au over 44 metres between 0 and 44 metres, including 14.02 g/t Au over 2 metres and 11.05 g/t Au over 2 metres, in a 50 metre deep hole, by fire assay;

- MA-RC-21-189 intersected 4.24 g/t Au over 16 metres between 20 and 36 metres, including 12.00 g/t Au over 2 metres, in a 36 metre deep hole, by fire assay; and

- MA-RC-21-003 intersected 1.30 g/t Au over 50 metres between 0 and 50 metres, including 10.32 g/t Au over 2 metres, in a 50 metre deep hole, by fire assay;

In the Leprechaun Deposit:

- LP-RC-21-043 intersected 2.61 g/t Au over 34 metres between 16 and 50 metres, including 16.93 g/t Au over 2 metres, in a 50 metre deep hole, by fire assay;

- LP-RC-21-026 intersected 2.00 g/t Au over 22 metres between 26 and 48 metres including 14.83 g/t Au over 2 metres, in a 50 metre deep hole, by screen metallic assay;

- LP-RC-21-001 intersected 3.37 g/t Au over 12 metres between 48 and 60 metres, in a 60 metre deep hole, by screen metallic assay; and

- LP-RC-21-029 intersected 1.21 g/t Au over 34 metres between 6 and 40 metres, in a 50 metre deep hole, by screen metallic assay.

All quoted intersections comprise “significant” intercepts of uncut gold assays in down-hole lengths (see Notes on the Calculation of Assay Intervals).

Figure 2: Location of 2021 RC Drill Holes in the Marathon Deposit

https://www.globenewswire.com/NewsRoom/AttachmentNg/51f9bf8d-3839-4c90-a412-993cf1cfea3d

Figure 3: Location of 2021 RC Drill Holes in the Leprechaun Deposit

https://www.globenewswire.com/NewsRoom/AttachmentNg/7739caa7-5d13-4615-8b06-8c99ec948cee

Interpretations of Mineralisation and Continuity

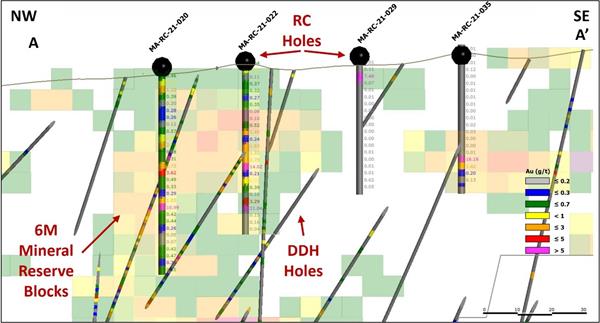

In general, good validation was achieved with the underlying block model across both deposits in a variety of mineralized settings. Qualitative visual comparison checks of RC drill holes against the underlying Mineral Reserve block models are illustrated in Figures 4 to 14. In each section, 2 metre RC samples are compared to 6 metre Mineral Reserve blocks and 1 metre diamond drill hole samples. Three different perspectives are presented: (1) comparison of Marathon Main Zone mineralised areas with RC (preliminary) fire assay data, (2) comparison of Marathon mineralisation at the 6 metre SMU “Postage Stamp” area with RC (preliminary) fire assay data, and (3) comparison of the eastern area of the Leprechaun Deposit where spatially distributed RC holes with (final) metallic screen fire assay data are available.

(1) Marathon Deposit “Main Zones”

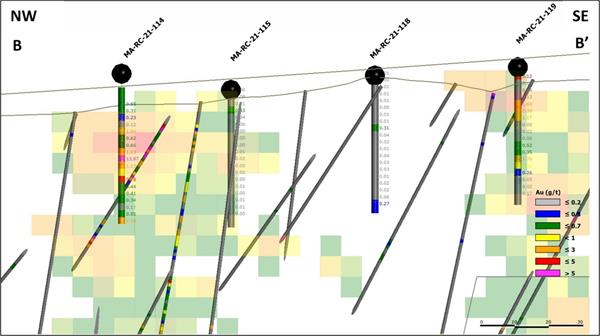

The large number of RC holes completed at the Marathon Deposit allowed a comprehensive comparison of mineralisation over a broad area. The RC drilling consistently validated the central cores of high grade and continuous “Main Zone” mineralization, with long intercepts of high-grade mineralisation coinciding with high-grade blocks and nearby high-grade diamond drill holes. (eg MA-RC-21-020 and 022, Section A-A’, Figure 4 and MA-RC-21-114, Section B-B’, Figure 5). More isolated footwall zones of mineralisation have also been successfully validated (eg MA-RC-21-029 and 035, Section A-A’, Figure 4 and MA-RC-21-119, Section B-B’, Figure 5).

RC drill holes that were less successful in validating the block model tended to be located at the margins of the Main Zones, in often lower grade blocks less well constrained by diamond drill holes (eg MA-RC-21-115, Section B-B’, Figure 5). This reflects a potential volume over-estimation in the Mineral Reserve block model. In the next iteration of Mineral Resource estimate for the Project, these RC data, along with additional geological modelling, will be used to establish a better constrained estimate of mineralised volumes in these marginal areas, which may result in a decrease in tonnes and ounces, offset potentially by an increase in average grade.

Figure 4: Section A-A’ from Marathon Deposit

https://www.globenewswire.com/NewsRoom/AttachmentNg/f980aff5-e978-4e33-aa25-c263c2c23a5e

Figure 5: Section B-B’ from Marathon Deposit

https://www.globenewswire.com/NewsRoom/AttachmentNg/549ae4f5-2123-4d0a-981b-652f79288acf

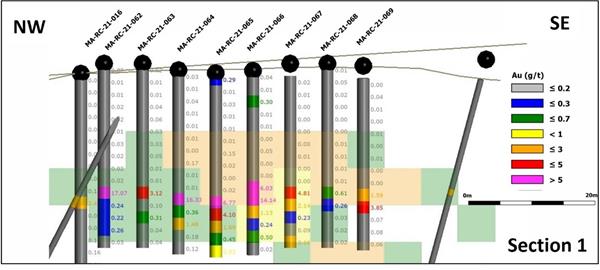

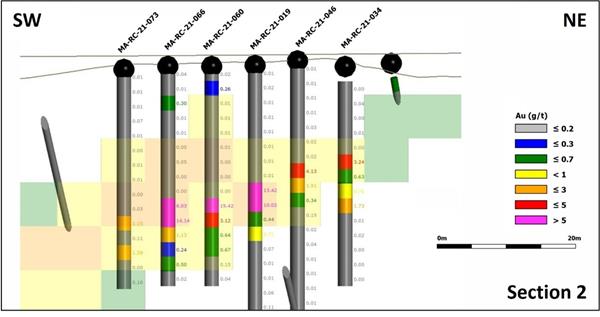

(2) Marathon Deposit 6 Metre SMU “Postage Stamp” Test Area

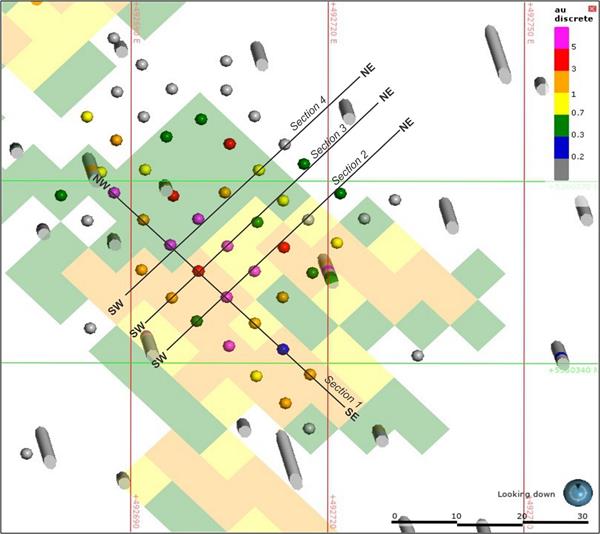

The RC drilling undertaken on a 6 by 6 metre grid at the “Postage Stamp” test area demonstrated excellent lateral continuity of mineralisation at the scale of the Project’s proposed selective mining methodology. Figures 6 to 10 illustrate the continuity in plan view and multiple sections of a single set of Set 1 veins located at approximately 15 metres deep, a thickness of between 6 and 12 metres, a minimum areal extent of 36 by 48 metres, and a characteristic southwest dip. This is the first time such detailed continuity in vein mineralisation has been demonstrated at the Valentine Gold Project, other than in surface outcrop.

In addition to having demonstrated lateral continuity, the RC data show significantly higher grades for the “Postage Stamp” veins than were expected from the underlying Mineral Reserve block model. Being fire assay results, these RC sample grades are likely still understated. The success of the “Postage Stamp” test in delineating a previously underestimated area of broad, continuous mineralisation, at high grades and close to the surface, indicates an opportunity to add additional localised areas of high grade mineralisation within the Marathon mining pit that may be currently under-sampled by the existing diamond drill hole coverage.

Taken together, these qualitative visual validation exercises at the Marathon Deposit demonstrate:

- Strong confidence in the location and broad continuity of the core of Main Zone mineralisation;

- Caution on the location and nature of the margins of the Main Zones, especially when not constrained by mineralized diamond drill holes; and

- Very strong confidence in the continuity and structural attitude of vein mineralization when drilled at the scale of the Project’s contemplated 6 metre SMU, validating the proposed mining methodology.

Figure 6: Marathon Deposit 6 metre SMU “Postage Stamp” Test Area. Plan map showing Mineral Reserve block model and location of RC drill holes. Illustrated grades represents grades of blocks and 6 metre RC sample composites sliced at a depth of approximately 18 metres.

https://www.globenewswire.com/NewsRoom/AttachmentNg/25d0296d-4160-4d63-8928-c8d3adca1d74

Figure 7: Section 1, Marathon Deposit 6 metre SMU “Postage Stamp” Test Area.

https://www.globenewswire.com/NewsRoom/AttachmentNg/778b0a59-ae5a-42b0-ac39-ff883505c681

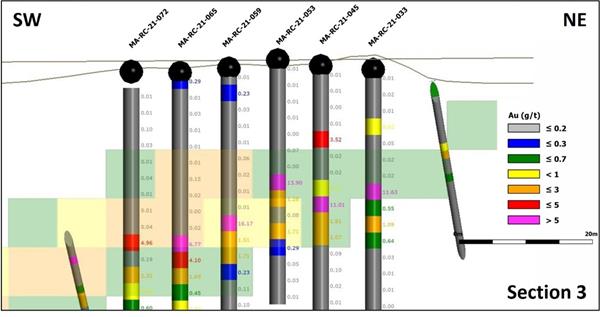

Figures 8-10: Sections 2,3 and 4, Marathon Deposit 6 metre SMU “Postage Stamp” Test Area.

https://www.globenewswire.com/NewsRoom/AttachmentNg/2c55a988-7df9-43f1-892c-8dd16b512eda

https://www.globenewswire.com/NewsRoom/AttachmentNg/465c2dc6-9aa4-48b4-8cda-d0f71c6573d8

https://www.globenewswire.com/NewsRoom/AttachmentNg/4c242d09-13cc-422f-8dac-689419851d81

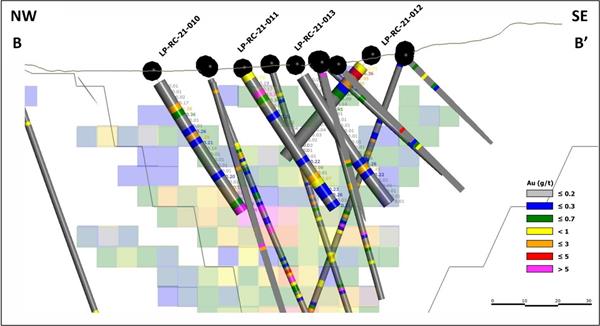

(3) Leprechaun Deposit Eastern Test Area

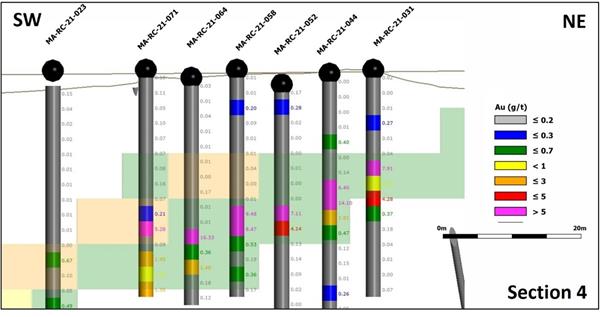

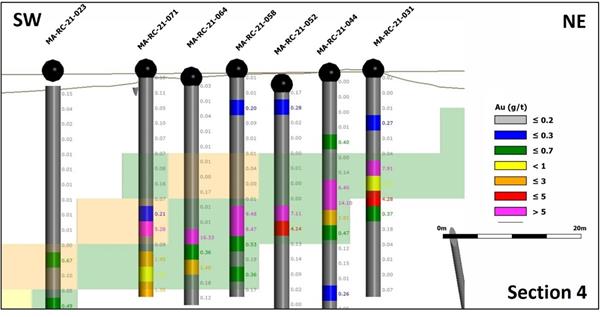

Most of the more limited number of RC drill holes completed at the Leprechaun Deposit were located at its eastern extent where sufficient access was available to complete 29 RC drill holes over an approximately 100 by 250 metre area to depths of between 30 and 60 metres. Screen metallic fire assay results have been received for each hole. Figures 11 to 14 illustrate good validation across multiple sections of the Mineral Reserve block model with high grades (eg LP-RC-21-001, Section A-A’, Figure 11 and LP-RC-21-29, Section C-C’, Figure 13).

Figure 11: Section A-A’ from Leprechaun Deposit

https://www.globenewswire.com/NewsRoom/AttachmentNg/328e4afb-f61c-485c-8eba-bd1c1ae20d1f

Figure 12: Section B-B’ from Leprechaun Deposit

https://www.globenewswire.com/NewsRoom/AttachmentNg/49eb2828-3289-4b53-9422-8968c78fe6e2

Figure 13: Section C-C’ from Leprechaun Deposit

https://www.globenewswire.com/NewsRoom/AttachmentNg/477f4d9d-ad1a-48f1-b5b3-dab742dd5f12

Figure 14: Section D-D’ from Leprechaun Deposit

https://www.globenewswire.com/NewsRoom/AttachmentNg/34b20006-fd44-4953-b2d0-dc04a68cf488

Next Steps

A final interpretation of the 2021 RC Drill Program will be conducted upon the receipt of all final screen metallic fire assays. Marathon is also awaiting the receipt of final assays for the 2021 diamond drilling at the Berry Deposit. Approximately 100,000 metres of drilling had been completed at Berry to the end of November 2021, and approximately 83,000 metres of fire assay results have been received to date. A large quantity of Berry screen metallic fire assay data also remain outstanding. When all of these data have been received, Marathon expects to complete an update to the Project’s overall Mineral Resource estimate. This will incorporate the results of all final RC assay data at Leprechaun and Marathon, the new diamond drill data at Berry, and updated geological models for all three deposits.

With the confirmation of the RC drilling method as an effective tool for conducting close spaced grade control drilling at the Valentine Gold Project, Marathon expects to commence an ongoing program of RC drilling at the Leprechaun and Marathon Deposits to establish a grade control dataset ahead of the commencement of pre-stripping activities. 24,000 metres of RC drilling has been budgeted for 2022, subject to the receipt of all applicable permits.

Sample Processing and Quality Assurance-Quality Control (“QA/QC”)

QA/QC protocols followed at the Valentine Gold Project include the insertion of blanks and standards at regular intervals in each sample batch. Two splits of the RC chips were collected at the RC drill rig, with one split retained at site, the other split was tagged and sent to Eastern Analytical Limited in Springdale, NL. Each split was between 4 and 5 kilograms in size. Reported RC samples are analyzed for Au either by fire assay (30g) with AA finish or metallic screens.

The Company’s standard practice is to initially analyze for Au by fire assay (30g) with AA finish. All samples above 0.30 g/t Au in economically interesting intervals are further assayed using metallic screen to mitigate the presence of coarse gold.

Notes on the Calculation of Assay Intervals

“Significant” assay intervals reported in this news release are defined as 2 metre or more sample intervals with an average fire assay or screen metallic fire assay result of greater than 0.7 g/t Au, representing the bottom cut-off for high-grade mill feed in the Marathon April 2021 Feasibility Study mine plan. Assay intervals with an average fire assay or metallic screen fire assay result of between 0.3 g/t Au and 0.7 g/t Au are above the cut-off used in the November 2020 and April 2021 Mineral Resource estimates for the Project but are not considered “significant” for the purposes of this news release.

Significant mineralized intervals reported in this news release are reported as drill lengths with an estimated true thickness of 70 - 95% of the drilling length, drill orientation dependent.

Qualified Persons

Disclosure of a scientific or technical nature in this news release was prepared under the supervision of David Ross, P.Geo. (Ont), Director of Mineral Resources for Marathon Gold Corporation. Exploration data quality assurance and control for Marathon is under the supervision of Jessica Borysenko, P.Geo (NL), GIS Manager for Marathon Gold Corporation. Marathon’s exploration drill programs are managed by Nic Capps, P.Geo. (NL), Exploration Manager for Marathon Gold Corporation. Mr. Ross, Ms. Borysenko, and Mr. Capps are qualified persons under National Instrument (“NI”) 43-101. The Qualified Person responsible for the preparation of the November 2020 and April 2021 Mineral Resource estimates for the Valentine Gold Project is Robert Farmer, P.Eng. of John T Boyd Company. The Qualified Person responsible for the preparation of the April 2021 Mineral Reserve estimate for the Valentine Gold Project is Marc Schulte, P.Eng. of Moose Mountain Technical Services. Mr. Farmer and Mr. Schulte are considered to be “independent” of Marathon and the Valentine Gold Project for purposes of NI 43-101.

About Marathon

Marathon (TSX:MOZ) is a Toronto based gold company advancing its 100%-owned Valentine Gold Project located in the central region of Newfoundland and Labrador, one of the top mining jurisdictions in the world. The Project comprises a series of five mineralized deposits along a 20-kilometre system. An April 2021 Feasibility Study outlined an open pit mining and conventional milling operation over a thirteen-year mine life with a 31.5% after-tax rate of return. The Project has estimated Proven Mineral Reserves of 1.40 Moz (29.68 Mt at 1.46 g/t) and Probable Mineral Reserves of 0.65 Moz (17.38 Mt at 1.17 g/t). Total Measured Mineral Resources (inclusive of the Mineral Reserves) comprise 1.92 Moz (32.59 Mt at 1.83 g/t) with Indicated Mineral Resources (inclusive of the Mineral Reserves) of 1.22 Moz (24.07 Mt at 1.57 g/t). Additional Inferred Mineral Resources are 1.64 Moz (29.59 Mt at 1.72 g/t Au). Please see Marathon’s Amended and Restated Annual Information Form for the year ended December 31, 2020 and other filings made with Canadian securities regulatory authorities and available at www.sedar.com for further details and assumptions relating to the Valentine Gold Project.

For more information, please contact:

Matt Manson

President & CEO

Tel: 416 987-0711

mmanson@marathon-gold.com | Amanda Mallough

Senior Associate, Investor Relations

Tel: 416 855-8202

amallough@marathon-gold.com |

To find out more information on Marathon Gold Corporation and the Valentine Gold Project, please visit www.marathon-gold.com.

Cautionary Statement Regarding Forward-Looking Information

Certain information contained in this news release, constitutes forward-looking information within the meaning of Canadian securities laws (“forward-looking statements”). All statements in this news release, other than statements of historical fact, which address events, results, outcomes or developments that Marathon expects to occur are forward-looking statements. Forward-looking statements include statements that are predictive in nature, depend upon or refer to future events or conditions, or include words such as “expects”, “anticipates”, “plans”, “believes”, “estimates”, “considers”, “intends”, “targets”, or negative versions thereof and other similar expressions, or future or conditional verbs such as “may”, “will”, “should”, “would” and “could”. We provide forward-looking statements for the purpose of conveying information about our current expectations and plans relating to the future, and readers are cautioned that such statements may not be appropriate for other purposes. More particularly and without restriction, this news release contains forward-looking information, including statements as to management's expectations with respect to, among other things, the matters and activities contemplated in this news release.

Forward-looking statements involve known and unknown risks, uncertainties and assumptions and accordingly, actual results and future events could differ materially from those expressed or implied in such statements. You are hence cautioned not to place undue reliance on forward-looking statements. In respect of the forward-looking statements concerning the interpretation of exploration results and the impact on the Project’s Mineral Resource estimate, the Company has provided such statements in reliance on certain assumptions it believes are reasonable at this time, including assumptions as to the continuity of mineralization between drill holes. A Mineral Resource that is classified as “inferred” or “indicated” has a great amount of uncertainty as to its existence and economic and legal feasibility. It cannot be assumed that any or part of an “indicated Mineral Resource” or “inferred Mineral Resource” will ever be upgraded to a higher category of Mineral Resource. Investors are cautioned not to assume that all or any part of mineral deposits in these categories will ever be converted into proven and probable Mineral Reserves.

By its nature, this information is subject to inherent risks and uncertainties that may be general or specific and which give rise to the possibility that expectations, forecasts, predictions, projections or conclusions will not prove to be accurate, that assumptions may not be correct and that objectives, strategic goals and priorities will not be achieved. Factors that could cause future results or events to differ materially from current expectations expressed or implied by the forward-looking statements include risks and uncertainties relating to the interpretation of drill results, the geology, grade and continuity of mineral deposits and conclusions of economic evaluations; uncertainty as to estimation of Mineral Resources; inaccurate geological and metallurgical assumptions (including with respect to the size, grade and recoverability of Mineral Resources); the potential for delays or changes in plans in exploration or development projects or capital expenditures, or the completion of feasibility studies due to changes in logistical, technical or other factors; the possibility that future exploration, development, construction or mining results will not be consistent with the Company’s expectations; risks related to the ability of the current exploration program to identify and expand Mineral Resources; risks relating to possible variations in grade, planned mining dilution and ore loss, or recovery rates and changes in project parameters as plans continue to be refined; operational mining and development risks, including risks related to accidents, equipment breakdowns, labour disputes (including work stoppages and strikes) or other unanticipated difficulties with or interruptions in exploration and development; risks related to the inherent uncertainty of production and cost estimates and the potential for unexpected costs and expenses; risks related to commodity and power prices, foreign exchange rate fluctuations and changes in interest rates; the uncertainty of profitability based upon the cyclical nature of the mining industry; risks related to failure to obtain adequate financing on a timely basis and on acceptable terms or delays in obtaining governmental or other stakeholder approvals or in the completion of development or construction activities; risks related to environmental regulation and liability, government regulation and permitting; risks relating to the Company’s ability to attract and retain skilled staff; risks relating to the timing of the receipt of regulatory and governmental approvals for continued operations and future development projects; political and regulatory risks associated with mining and exploration; risks relating to the potential impacts of the COVID-19 pandemic on the Company and the mining industry; changes in general economic conditions or conditions in the financial markets; and other risks described in Marathon’s documents filed with Canadian securities regulatory authorities, including the Amended and Restated Annual Information Form for the year ended December 31, 2020.

You can find further information with respect to these and other risks in Marathon’s Amended and Restated Annual Information Form for the year ended December 31, 2020 and other filings made with Canadian securities regulatory authorities available at www.sedar.com. Other than as specifically required by law, Marathon undertakes no obligation to update any forward-looking statement to reflect events or circumstances after the date on which such statement is made, or to reflect the occurrence of unanticipated events, whether as a result of new information, future events or results otherwise.